Trade ePrex 4.0 (Model 400) Official Registration

Secure your authentic Trade ePrex 4.0 (Model 400) account via BTI.LIVE and gain access to a complimentary Personal Account Manager for seamless setup assistance.

In an era where digital currency has become a cornerstone of modern finance, platforms like Trade ePrex 4.0 (Model 400) are subject to intense scrutiny by potential investors and market analysts alike. As we enter 2023, the question of whether Trade ePrex 4.0 (Model 400) stands as a legitimate trading tool or a sophisticated scam is of paramount importance to those looking to capitalize on the volatility of the cryptocurrency markets.

This review aims to dissect the elements that constitute the Trade ePrex 4.0 (Model 400) trading system, from its advertised AI-driven technology to its user testimonials and security measures. With an objective examination of its operational framework and performance results, we seek to illuminate the realities behind its bold assertions, thus equipping our audience with a comprehensive understanding necessary to evaluate the credibility of Trade ePrex 4.0 (Model 400) platform in the context of an increasingly complex financial technology landscape.

Key Takeaways

After using Trade ePrex 4.0 (Model 400) AI-driven automation, I’ve found that it consistently enhances my trading strategy, allowing me to make more informed decisions in the volatile cryptocurrency market. Its intuitive interface and real-time analytics have truly improved my trading experience.

- Trade ePrex 4.0 (Model 400) reports a win rate of approximately 88%, showcasing its effective algorithm.

- The platform charges a 0.1% service fee on profits earned, which is competitive within the industry.

- There are no hidden charges, ensuring transparency for all users.

Understanding Trade ePrex 4.0 (Model 400)

Trade ePrex 4.0 (Model 400)

In the ever-evolving landscape of digital finance, platforms like Trade ePrex 4.0 (Model 400) stand at the forefront, promising both opportunities and risks. This review delves into the advantages that make Trade ePrex 4.0 (Model 400) appealing, such as its high win rate, transparent fees, and security measures. However, it also addresses critical concerns, including founder anonymity and the sustainability of earnings. Join us as we navigate through the complexities of this AI-driven trading platform, aiming to provide a balanced perspective for potential investors in the cryptocurrency market.

Price: 250

Price Currency: USD

Operating System: Web-based, Windows 10, Windows 7, Windows 8, OSX, macOS, iOS, Android 7.1.2, Android 8.1, Android 9.0, Android 10.0, Android 11.0, Android 12.0, Android 13.0

Application Category: Finance Application

4.89

Pros

- Transparency: Trade ePrex 4.0 (Model 400) emphasizes transparency by having no hidden charges, providing users with a clear understanding of their costs.

- User-Friendly Interface: The platform is designed to cater to both novice and experienced traders, offering an intuitive interface that simplifies the investment process.

- Risk Management Protocols: Incorporation of risk management strategies helps protect users' capital and minimize potential losses.

- Continuous Trading: With a 24/7 operation, the platform takes advantage of all market conditions, potentially enhancing returns for investors.

- Security Measures: Trade ePrex 4.0 (Model 400) implements advanced encryption protocols and safety measures, demonstrating a proactive approach to cybersecurity.

- Positive User Testimonials: Generally positive feedback from users supports the platform's credibility and past performance.

- Automated Trading Benefits: Features like continuous market analysis, emotionless decision-making, and backtesting capability enhance efficiency and potential profitability for investors.

- Regulatory Compliance: Working with regulated brokers suggests adherence to industry standards, mitigating some risk factors.

Cons

- Customer Support Quality: While generally positive, user testimonials indicate the need for responsive and helpful customer support, emphasizing potential areas for improvement.

- Minimum Deposit Requirement: A minimum deposit of $250 is required, which could be a financial barrier for some users and requires careful consideration in the context of individual financial capacities.

- Risk of Automated Trading: While automated trading offers efficiency, it also poses risks, including the lack of nuance compared to human traders and the potential for technical glitches.

- Limited Information about the AI Algorithm: The review provides a broad overview of the AI algorithm but lacks detailed technical insights, which may leave some users wanting more information.

- Market Volatility Risks: Cryptocurrency markets are inherently volatile, and investors should be aware of the risks associated with trading in such markets, even with the assistance of automated tools.

Understanding Trade ePrex 4.0 (Model 400) begins with recognizing it as an automated cryptocurrency trading platform that leverages AI algorithms to facilitate potentially profitable trades for its users.

Trade ePrex 4.0 (Model 400) performance analysis is crucial for investors prioritizing safety and seeking assurances of the platform’s reliability.

Evaluating the effectiveness of Trade ePrex 4.0 (Model 400) AI algorithm involves a deep dive into its ability to analyze vast quantities of market data, execute trades with precision, and adapt to the volatile cryptocurrency market.

An analytical approach to understanding Trade ePrex 4.0 (Model 400) involves examining empirical data and user testimonials to assess how the platform performs under various market conditions.

This unbiased evaluation aims to provide potential users with a clear understanding of how Trade ePrex 4.0 (Model 400) operates and the level of risk involved in using such trading tools.

Key Features Explained

Trade ePrex 4.0 (Model 400) algorithmic prowess serves as the cornerstone of its key features, offering an automated trading experience that is both sophisticated and user-friendly. Understanding profitability and evaluating user experiences are essential aspects of any trading platform, and Trade ePrex 4.0 (Model 400) claims to prioritize these concerns through the following features:

- Automated Trading System: Utilizes AI to analyze market data and execute trades, aiming to maximize profitability.

- User-Friendly Interface: Designed for both novice and experienced traders, simplifying the investment process.

- Risk Management Protocols: Incorporates strategies to protect users’ capital and minimize losses.

- 24/7 Operation: Allows continuous trading, taking advantage of all market conditions to enhance potential returns.

These features collectively promise a secure and potentially profitable trading environment, but due diligence is advised.

Minimum Deposit Requirements

While the automated trading system and user-friendly interface of Trade ePrex 4.0 (Model 400) cater to accessibility and ease of use, the platform also establishes a clear financial threshold with its minimum deposit requirement of $250.

This initial investment is a standard practice in the industry, serving as a gateway for the account verification process and ensuring commitment from the user.

It’s imperative to consider that this deposit is the baseline for engaging in the trading activities on the platform and is pivotal in the subsequent profitability analysis.

Potential users must evaluate this requirement in the context of their financial capacity and investment goals.

The emphasis on safety is paramount, and users should proceed with an understanding that while the system presents opportunities for gains, all trading involves risk.

Fee Structure Overview

Diving into the fee structure of Trade ePrex 4.0 (Model 400), investors will encounter a straightforward commission of 0.1% on each trade executed by the platform. Understanding the fee structure is crucial for investors prioritizing safety and transparency in their trading endeavors. Here’s a concise breakdown:

- Commission Rate: A fixed commission of 0.1% applies to each trade, ensuring predictability in costs.

- AI Algorithm Accuracy: A high-precision AI algorithm potentially minimizes unnecessary trades and associated costs.

- No Hidden Fees: Transparency is a key feature, with no undisclosed charges to surprise investors.

- Safety-Focused Approach: The fee structure aligns with risk management practices, supporting a responsible trading environment.

An analytical review of these components suggests a fair and secure model for users of the platform.

AI Algorithm Insights

The AI algorithm that underpins Trade ePrex 4.0 (Model 400) trading platform is designed to analyze vast quantities of market data to identify potentially profitable trading signals. This algorithm’s accuracy is pivotal for users who prioritize safety in their investments. It continuously undergoes profitability analysis to ensure that the trading strategies it employs are effective. The following table summarizes three essential aspects of the AI’s functionality:

| Aspect | Description | Relevance to Trader |

|---|---|---|

| Data Analysis | In-depth market data parsing | Enhances decision-making |

| Signal Accuracy | Precision of buy/sell triggers | Directly impacts profitability |

| Risk Assessment | Evaluates potential loss scenarios | Informs risk management |

| Historical Learning | Uses past outcomes to improve | Refines future predictions |

| Continuous Optimization | Regular updates for accuracy | Maintains system relevance |

Through a professional, analytical, and unbiased approach, traders can understand how the AI algorithm endeavors to safeguard and potentially grow their investments.

Automated Trading Benefits

How does automated trading with platforms like Trade ePrex 4.0 (Model 400) enhance the efficiency and potential profitability for investors in the cryptocurrency market? By leveraging advanced AI algorithms, such platforms aim to optimize trade execution, reduce human error, and exploit market inefficiencies. However, investors must remain cognizant of automated trading risks.

Here are key benefits to consider:

- Continuous Market Analysis: The AI algorithm provides round-the-clock market surveillance, identifying opportunities without the constraints of human traders.

- Emotionless Decision Making: Automated systems execute trades based on pre-set criteria, mitigating emotional influences that often lead to suboptimal investment decisions.

- Speed of Execution: Trades are executed at a pace unattainable by manual trading, which can be crucial in the highly volatile cryptocurrency market.

- Backtesting Capability: Investors can assess the impact of AI algorithm strategies through historical data before risking capital.

24/7 Trading Capability

Building on the automated trading benefits provided by platforms like Trade ePrex 4.0 (Model 400), the 7 trading capability offers an added advantage by enabling continuous trading activity, 24 hours a day, 7 days a week, to take full advantage of the cryptocurrency market’s non-stop nature. This round-the-clock operation aligns with sophisticated trading strategies and ongoing market analysis, ensuring that opportunities are never missed due to time constraints.

| Feature | Benefit |

|---|---|

| 24/7 Operations | Maximizes potential for profit by trading continuously |

| Market Analysis | Uses AI to analyze market trends for informed trading decisions |

| Trading Strategies | Employs advanced strategies to navigate market volatility |

Investors seeking a secure trading environment may find reassurance in the platform’s commitment to constant market engagement and strategic trading.

Legitimacy Concerns Addressed

Addressing the legitimacy concerns, extensive research and user testimonials indicate that Trade ePrex 4.0 (Model 400) is a credible cryptocurrency trading platform. However, the anonymity of its founders has raised some questions among potential users.

- Transparency Concerns: The lack of information about the platform’s founders could be a red flag for some investors, necessitating a demand for greater transparency.

- Historical Performance: Past performance and user reviews suggest a pattern of profitability, which supports the platform’s credibility.

- Regulatory Compliance: Working with regulated brokers suggests adherence to industry standards, mitigating some risk factors.

- Customer Support Quality: Responsive and helpful customer support contributes significantly to user trust and platform reliability.

In a market where safety is paramount, these points are crucial for investors considering Trade ePrex 4.0 (Model 400).

Safety and Security Measures

When evaluating the safety and security measures of Trade ePrex 4.0 (Model 400), it is essential to consider the platform’s implementation of encryption protocols and user data protection policies.

A thorough analysis reveals that Trade ePrex 4.0 (Model 400) has incorporated advanced encryption to safeguard user information and transactional data, providing a secure environment for trading activities.

Account verification is a critical component of the platform’s safety measures, mitigating the risk of unauthorized access and potential identity theft. This process underscores the platform’s commitment to user security.

Furthermore, the adoption of these safety protocols demonstrates a proactive approach to cybersecurity, essential in the digital asset space. Users looking for security in their trading endeavors would find reassurance in Trade ePrex 4.0 (Model 400) systematic protection measures.

User Testimonials Evaluated

Evaluating user testimonials for Trade ePrex 4.0 (Model 400) reveals a pattern of generally positive feedback, although the authenticity and representativeness of such reviews warrant a closer examination. Prospective users should consider the following:

- Diversity of Experiences: Testimonials reflect a range of user satisfaction levels, indicative of varying success with the platform’s trading strategies.

- Consistency with Claims: Reviews should be cross-referenced with the platform’s stated capabilities to gauge reliability.

- Volume of Feedback: A substantial number of testimonials can suggest a more accurate picture of user experiences.

- Independent Verification: Seek out feedback from independent forums or consumer protection sites to validate the testimonials’ legitimacy.

An analytical approach to these aspects will help ensure that individuals have a clear understanding of what to expect from Trade ePrex 4.0 (Model 400).

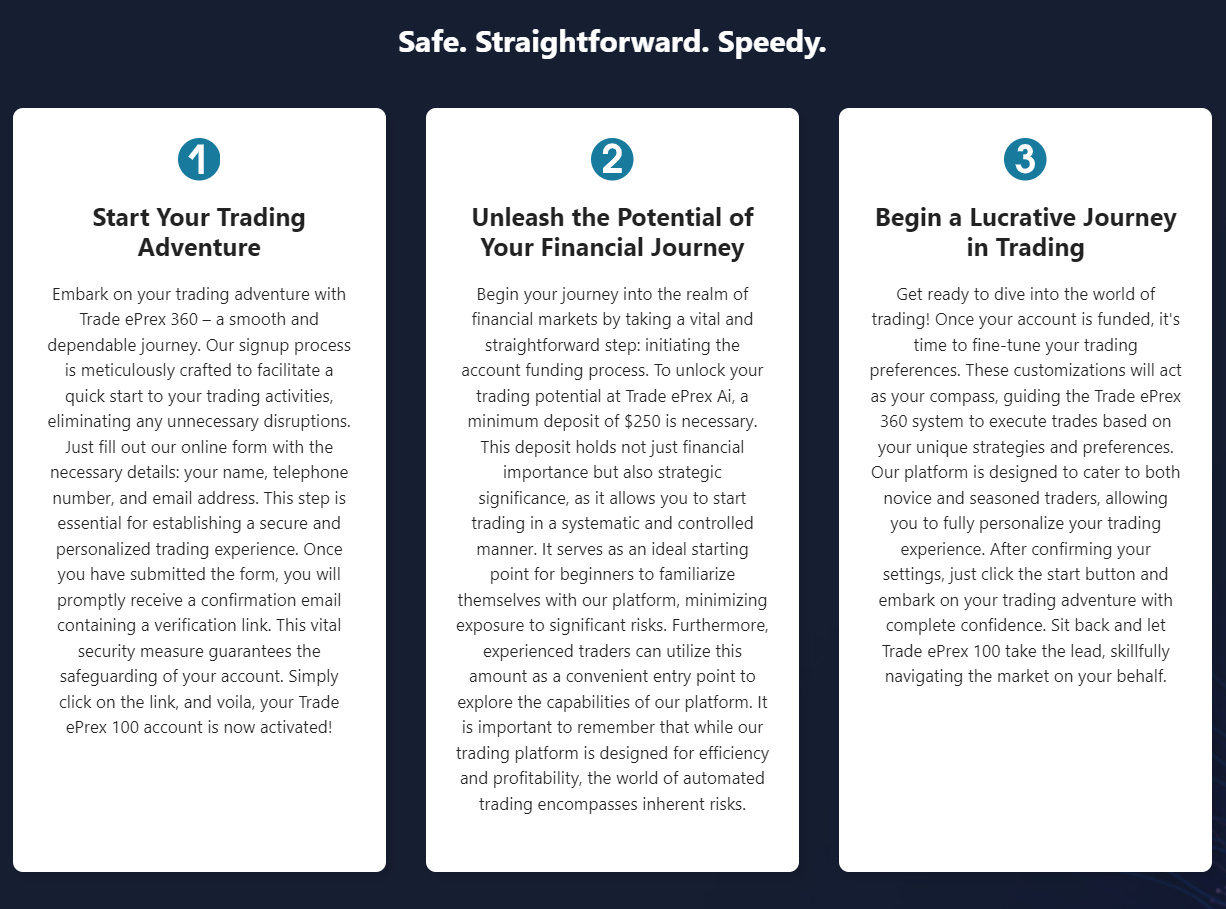

Setting Up Your Account

Having highlighted the importance of user testimonials in understanding the platform’s efficacy, we now turn our attention to the practical step of setting up an account with Trade ePrex 4.0 (Model 400). The account verification process is a critical measure to ensure safety and authenticity. Prospective users should be prepared to provide personal identification documents. Customer support availability is crucial, especially for new users navigating the setup process for the first time.

| Step | Description | Support |

|---|---|---|

| 1 | Registration | Access to guidance via chat |

| 2 | Verification | Document review assistance |

| 3 | Deposit | Secure transaction support |

| 4 | Demo Trading | Walkthroughs available |

| 5 | Live Trading | 24/7 assistance |

This table encapsulates the systematic approach required to successfully commence trading with Trade ePrex 4.0 (Model 400), emphasizing an analytical and clear understanding of each phase.

Automated Mode Functionality

The automated mode of Trade ePrex 4.0 (Model 400) is designed to streamline the trading process by executing transactions based on predetermined algorithmic strategies without the need for manual intervention. This functionality offers several benefits of automated trading:

- Consistency: Automated trading ensures a disciplined and consistent approach, as trades are executed according to the strategy without emotional influence.

- Efficiency: It enables 24/7 market participation, potentially capturing opportunities even when the trader is not actively monitoring the markets.

- Speed: Automated systems can respond more rapidly to market changes than a human trader.

- Backtesting: Strategies can be backtested on historical data to optimize performance.

For those desiring safety and aiming to maximize returns in automated mode, it’s essential to employ tips such as setting appropriate risk parameters and regularly reviewing strategy performance.

Broker Selection Tips

When selecting a broker for use with Trade ePrex 4.0 (Model 400), it is crucial to consider their regulatory status, fees, and the range of assets they offer to ensure a secure and cost-effective trading experience.

An analytical comparison of different cryptocurrency trading platforms reveals that a regulated broker minimizes the risk of fraud and ensures compliance with financial laws.

Additionally, it’s important to weigh the pros and cons of automated trading. While it offers convenience and the potential for consistent returns, it may also lack the nuance a skilled trader brings to market analysis.

Ensure the broker’s fee structure is transparent to avoid unexpected costs that can erode profits.

A broad asset selection allows for diversification, which is a key strategy in managing trading risks.

Earning Potential Analysis

Understanding the importance of a secure and cost-effective broker is essential when considering Trade ePrex 4.0 (Model 400) as an investment option. Investors should analyze its earning potential to gauge its viability.

- Analyzing Profitability: Investors must consider historical performance data, acknowledging that past success does not guarantee future returns.

- Risk Assessment: Thorough risk evaluation should be conducted, taking into account market volatility and the platform’s trading strategy.

- Return on Investment (ROI): Potential ROI should be weighed against the initial deposit and any applicable fees, including Trade ePrex 4.0 (Model 400) 0.1% commission.

- Sustainability of Earnings: Assess the long-term sustainability of the trading model employed by Trade ePrex 4.0 (Model 400), which is essential for ongoing profitability.

Investors are urged to approach Trade ePrex 4.0 (Model 400) with caution, balancing the allure of automated gains with the realities of cryptocurrency trading risks.

Risk Management Strategies

In the realm of cryptocurrency trading, implementing robust risk management strategies is crucial for safeguarding investments on platforms like Trade ePrex 4.0 (Model 400). Users must apply comprehensive risk management techniques to mitigate potential losses while maximizing the profit potential analysis.

An analytical approach to trading on Trade ePrex 4.0 (Model 400) involves setting stop-loss orders, diversifying cryptocurrency portfolios, and understanding the volatility of the market. It is imperative for traders to establish clear rules for entry and exit points, and to adhere strictly to these guidelines.

Additionally, calculating the risk-reward ratio aids in making informed decisions that align with individual financial goals. By prioritizing safety, traders can effectively navigate the uncertainties of the crypto market while using Trade ePrex 4.0 (Model 400) automated trading features.

Frequently Asked Questions

What exactly is Trade ePrex 4.0 (Model 400)?

It stands as a groundbreaking platform utilizing the power of cutting-edge machine learning and quantum computing to analyze cryptocurrency market patterns. Our advanced technology empowers users with smart, automated trading strategies, providing them with a unique competitive edge.

How does Trade ePrex 4.0 (Model 400) operate?

Employing sophisticated algorithms, Trade ePrex 4.0 (Model 400) thoroughly analyzes market patterns, real-time news, and the ever-changing social media landscape to accurately predict upcoming price fluctuations in the cryptocurrency sector. As a result, it strategically carries out trades, capitalizing on these invaluable insights.

Which cryptocurrencies are compatible with Trade ePrex 4.0 (Model 400)?

Trade ePrex 4.0 (Model 400) accommodates a diverse range of cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, and Ripple. The algorithm embedded in Trade ePrex 4.0 (Model 400) is adept at executing automated trades across the cryptocurrency market, utilizing market APIs. Our customer service is readily available for additional support if required.

Conclusion

In conclusion, Trade ePrex 4.0 (Model 400), akin to a ship navigating the treacherous waters of the cryptocurrency sea, claims to offer a sophisticated compass for traders through its AI-driven automation.

While its allure is strong, potential investors must chart these waters with caution, as the siren’s song of easy profits can lead to perilous outcomes.

Rigorous due diligence and risk management remain essential, for even the most advanced algorithm cannot guarantee safe passage through the volatile storms of the market.

Our Review Methodology

We meticulously evaluate crypto trading robots by synthesizing information from various tests, user reviews, and feedback from multiple online sources. This thorough methodology enables us to present a comprehensive perspective that encompasses diverse viewpoints.

For a deeper understanding of our testing procedures, we invite you to explore our “Why Trust Us” and “How We Test” pages. Recognizing the abundance of misleading information online, especially concerning trading platforms, we diligently verify and cross-reference details to provide a precise and trustworthy review of Trade ePrex 4.0 (Model 400).

Trade ePrex 4.0 (Model 400) Highlights

| 🤖 Type of Platform | Crypto |

| ✅ Scam or Legit | Legit |

| ⌛ Withdrawal Timeframe | 24 hours |

| 🎧 Customer Support | Contact form, Live Chat, Email |

| 💵 Deposit Options | PayPal, Skrill, Neteller, UnionPay, Webmoney, Yandex, Visa, Mastercard, AMEX, Diners Club |

| ⚙️ Compatibility With MT4 and MT5 | Yes |