MARKET SURVEILLANCE REPORT – DECEMBER 2018

:: Methodologies for our reports have evolved since our initial report focusing primarily on web traffic, followed by our September report, in which we added data collected from exchanges on mobile app usage and API trading.

For our December report, we’ve taken a deeper dive into specific trading pairs on exchanges showing clear evidence of wash trading. This has always been our goal. However, we wanted to make sure this data was as accurate as possible, so we’ve been updating and perfecting these algorithms over the past 3 months.

During this time, we have spent countless hours watching order books, analyzing volume data points, and speaking with market makers, high-frequency traders, and trade surveillance consultants. We have collected an enormous amount of data and feel confident releasing these figures.

Also, coming out of this data, we have discovered 4 different bot strategies used to inflate exchange volume numbers. Some of these bots appear to be set to different trading pairs depending on the time of day. Settings are changed based on current volume trends or hype around a given token for that time period.

However, we have picked up several data points, which allowed us to reverse-engineer some of their settings. Unfortunately, we cannot make the exact data we used to determine these settings public, so that we can stay ahead of these bad actors.

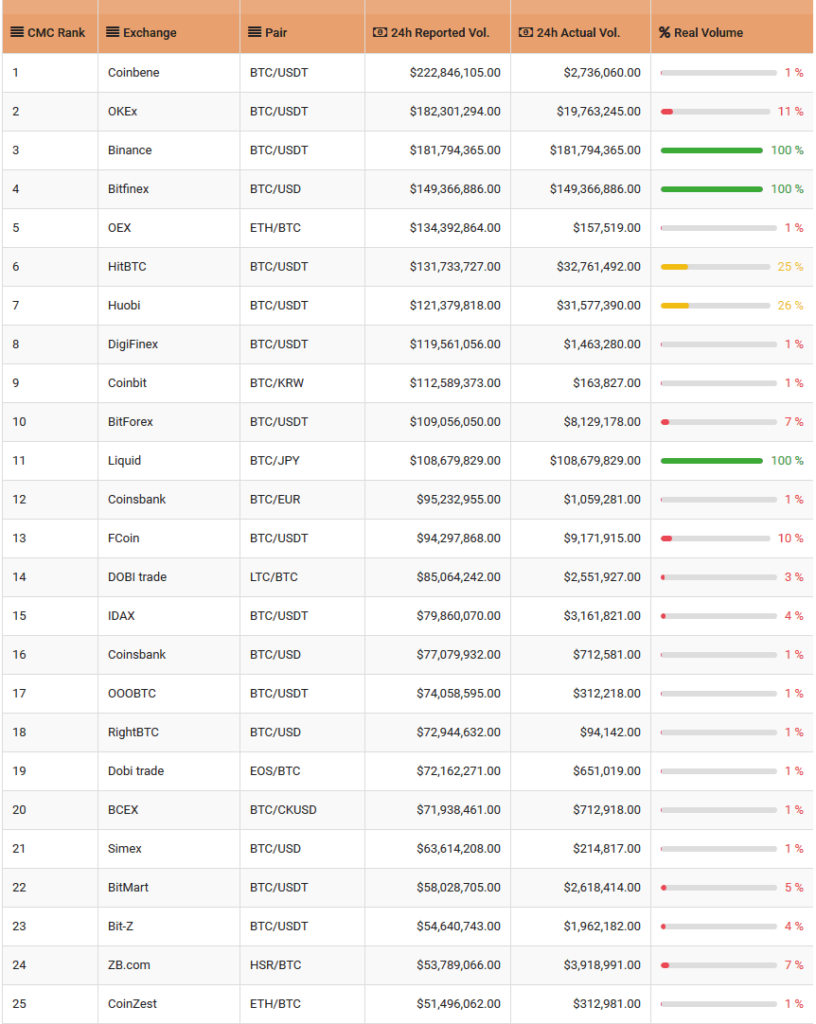

Top 25 BTC Pairs

Included in this report we have calculated the true volume of the CMC top 25 BTC trading pairs. Most of these pairs actual volume is under 1% of their reported volume on CMC. We noted only 3 out of the top 25 pairs not to be grossly wash trading their volume, Binance, Bitfinex and Liquid.

OKEx has been moved to our Exchange Advisory List as we found just about all of their top 30 traded tokens to be engaging in wash trading when processed through our algorithms. It appears they have benefited the most from the CMC referral traffic, as our estimated adjusted volume for them would still keep them in the top 10.

Huobi was also found to be wash-trading many of their top 25 pairs volume numbers, but to a lesser degree than OKEx. Hit BTC’s top 25 has shown clear evidence of wash trading as well. Both of their adjusted numbers for this report have also landed them on our Advisory List. Please contact us for full reports on any pairs on any exchange.

We checked into Bithumb after numerous reports and found a large amount of wash trading primarily with Monero, Dash, Bitcoin Gold, and ZCash. Top wash traded tokens on Bithumb appear to change depending on the month.

TOP 25 BTC PAIRS ON CMC

Based on this data over 80% of the CMC top 25 BTC pairs volume is wash traded. These exchanges continue to use these strategies as a business model to steal money from aspiring token projects.

Listing Fees are Big Business

Based on the information we’ve received from many tokens in the space, the average project spent over $50,000 this year in listing fees from exchanges on our Advisory List. This adds up to an estimated $100,000,000 stolen in 2018 from the crypto ecosystem.. and with over 50 exchanges wash trading over 95% of their volumes, this is a 500K a year scheme, with some exchanges making over one million dollars this year just from collecting these fees.

We advise any token project to contact us regarding any exchange requesting large listing fees, especially those on our Advisory List. Many of these exchanges exist solely to collect these fees while their bots run their exchanges. We also have data on fair listing fee costs for exchanges which are not using wash trading bots. We’ve had reports on fees ranging from 2BTC up to 75BTC.

BTI in 2019

Soon, we will release our Initial Investor Security Report highlighting current exchange security measures and ways the space can make current and future investors feel safer with their funds. The past year has seen the largest losses of investor funds due to phishing and hacking than any other year, and with these numbers growing the whole ecosystem will continue to suffer. This report will also contain security ratings for all exchanges not currently on our Advisory List.

Heading into 2019 we will continue collecting true volume data on individual pairs in an effort to curb further manipulation. We will also be contacting all exchanges to implement the best security controls, hoping to see media reports on the decline of stolen crypto funds in 2019.

We are always looking for more transparency partners and ways in which we can all collaborate to clean up the space and further progress. Also, please contact us with any feedback or suggestions for future reports or if you would like to join our research team. Below we have calculated the actual top 10 BTC trading pairs.