Intermagnum Review: Navigating the Seas of Trading with Safety, Innovation, and User-Friendly Features

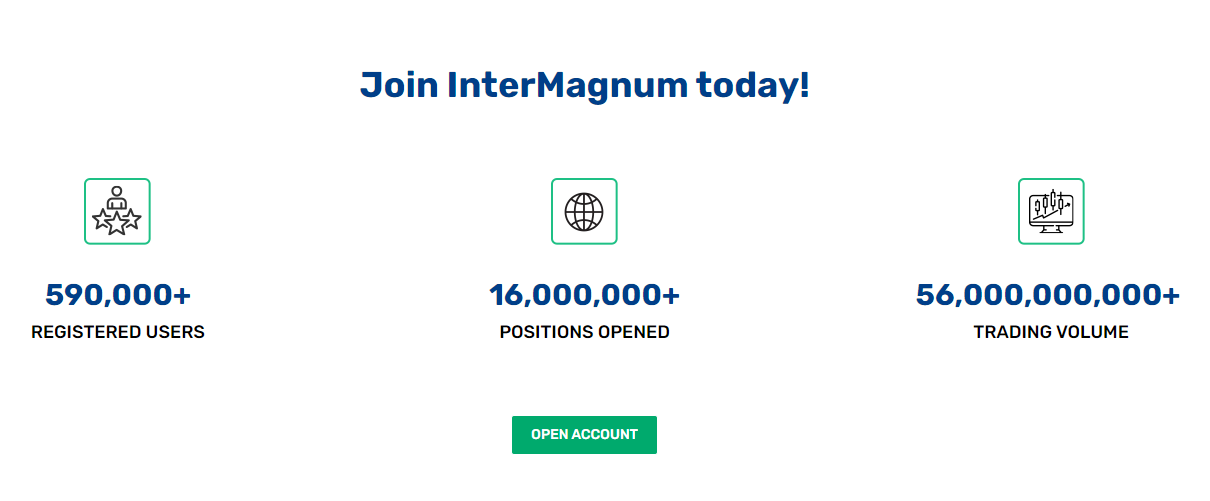

Intermagnum has truly impressed me with its exceptional trading platform. Not only does it have a vast user base of over 300,000 registered customers worldwide, but it also offers a wide range of features and services that cater to traders of all levels of expertise.

Let’s dive into the details and explore what makes Intermagnum stand out from the crowd.

| Product Name | Summary |

|---|---|

| Trading Platform | Intermagnum’s trading platform is user-friendly and packed with powerful tools and features, making it easy for traders to execute trades and analyze the market. |

| Wide Range of Instruments | Intermagnum offers an extensive selection of trading instruments, including Forex, stocks, indices, commodities, and cryptocurrencies, providing traders with ample opportunities to diversify their portfolios. |

| Educational Resources | The platform offers a wealth of educational resources, including video tutorials, webinars, and market analysis, empowering traders to enhance their knowledge and skills. |

| Copy Trading | Intermagnum’s innovative copy trading feature allows users to automatically replicate the trades of successful traders, making it an excellent option for beginners or those who prefer a hands-off approach. |

| Customer Support | Intermagnum provides excellent customer support, with a dedicated team available 24/5 to assist traders with any queries or issues they may encounter. |

| Regulation and Security | Intermagnum is regulated by reputable financial authorities, ensuring that traders’ funds are secure and protected. The platform also utilizes advanced encryption technology to safeguard personal and financial information. |

One aspect that particularly impressed me about Intermagnum is its transparent pricing structure. The platform charges competitive spreads and offers various account types to suit different trading preferences. Moreover, there are no hidden fees or commissions, which adds to the overall transparency and trustworthiness of the platform.

Additionally, Intermagnum boasts an impressive win rate, with a high percentage of successful trades. This provides traders with confidence in the platform’s capabilities and increases the chances of achieving profitable outcomes.

In conclusion, Intermagnum is a top-notch trading platform that caters to the needs of traders worldwide. With its user-friendly interface, diverse range of instruments, educational resources, and excellent customer support, it’s no wonder why Intermagnum continues to attract traders from all walks of life. I highly recommend giving Intermagnum a try for your trading needs.

Key Takeaways

My Positive Experience with Intermagnum

I have had a great experience using Intermagnum for my trading needs. The platform is user-friendly and offers a wide range of investment options. The safety and reliability of Intermagnum are top-notch, giving me peace of mind while trading.

Here are some key points about Intermagnum:

- Intermagnum has a high win rate and offers competitive fees, making it a cost-effective option for traders.

- The platform is regulated by multiple authorities, including the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC), ensuring a secure and trustworthy trading environment.

- Intermagnum provides innovative features, such as seamless mobile trading experiences, making it convenient for traders to access their accounts on the go.

- The customer support team at Intermagnum is responsive and helpful, providing assistance whenever I have any questions or issues.

Overall, Intermagnum has exceeded my expectations with its commitment to safety, innovation, and user-friendly features. I highly recommend it to anyone looking for a reliable and trustworthy trading platform.

Safety and Regulation

Intermagnum

Intermagnum is a leading online trading platform with over 300,000 registered users globally. Its user-friendly interface and powerful tools make it ideal for traders of all levels. The platform offers a diverse range of instruments, educational resources, and innovative features like copy trading. With excellent customer support and regulatory compliance, Intermagnum stands out for its transparency in pricing and impressive win rate. It provides a secure and trustworthy environment, making it a top choice for traders worldwide.

Price: 250

Price Currency: USD

Operating System: Web-based, iOS, Android 7+

Application Category: Finance Application

4.88

Pros

- Optimal liquidity, catering to the needs of high-volume traders.

- Diverse selection of trading pairs, encompassing fiat currencies.

- Incorporates advanced trading functionalities such as margin trading and lending.

- Facilitates access to liquidity pools and a variety of order types.

- Holds a reputable standing within the cryptocurrency community.

Cons

- Verification is necessary for both fiat deposits and withdrawals.

- The interface may pose challenges for beginners due to its complexity.

- There is a controversial history involving regulatory issues.

- Occasional problems with customer support responsiveness have been reported by some users.

Safety and Regulation

In terms of safety and regulation, Intermagnum stands out as a brokerage firm authorized by various Tier-1, Tier-2, and Tier-4 regulators, ensuring a secure trading environment for its clients. Regulatory compliance is a top priority for Intermagnum, as evidenced by its adherence to stringent guidelines set forth by regulators like ASIC, CIRO, JFSA, and MiFID.

This commitment to regulatory standards not only protects the interests of investors but also instills confidence in the platform. Investor protection is paramount, with Intermagnum taking proactive measures to safeguard client funds and ensure fair trading practices.

Trading Features and Fees

With competitive spreads averaging 0.9 pips, Intermagnum offers a range of trading features and fees tailored to meet the needs of both novice and experienced traders. Intermagnum provides various account types to cater to different trading preferences, including retail, professional, and Islamic accounts.

The commission structure at Intermagnum is transparent, with no commissions charged on trades but rather embedded within the spreads. For professional accounts, lower spreads of 0.6 pips are available. Discounts are offered to Active Traders or VIP clients based on trading volume or account size.

Additionally, Intermagnum supports multiple payment methods like PayPal, Skrill, Visa/Mastercard, and Bank Wire, making deposits and withdrawals convenient for traders. The minimum deposit requirement of $100 makes it accessible to a wide range of traders.

Mobile Platforms and Tools

Intermagnum offers a diverse range of mobile platforms and tools designed to enhance the trading experience for users of all levels of expertise. The mobile trading benefits include the availability of platforms like IntermagnumGO, AvaOptions, and the MetaTrader suite, catering to traders who prefer on-the-go access.

These platforms offer syncing watchlists, AvaProtect for risk management, and a wide array of 93 indicators in mobile charts for technical analysis. Additionally, traders can leverage copy trading options through ZuluTrade and DupliTrade for automated strategies.

Intermagnum also stands out with tool customization options, integrating Trading Central tools and alerts, allowing users to tailor their trading environment to suit their individual preferences and strategies effectively.

Investment Options and Symbols

Offering a diverse selection of investment options, Intermagnum presents traders with a robust array of 1,260 tradeable symbols to choose from, providing ample opportunities for portfolio diversification and strategic trading decisions.

- Risk Management: With such a wide range of symbols, traders can implement various risk management strategies to protect their investments.

- Asset Diversification: The extensive number of tradeable symbols allows for effective asset diversification, spreading risk across different instruments.

- Strategic Trading Decisions: Traders can make informed decisions based on the multitude of symbols available, catering to different trading strategies and market conditions.

Payment Methods and Deposits

When considering payment methods and deposits at Intermagnum, traders have access to a diverse range of options to facilitate seamless transactions. Intermagnum supports various payment methods, including PayPal, Skrill, Visa/Mastercard, and Bank Wire, offering flexibility to users. Additionally, Intermagnum provides a minimum deposit requirement of $100, making it accessible to a wide range of traders.

| Payment Methods | Deposit Bonuses |

|---|---|

| PayPal | Yes |

| Skrill | Yes |

| Visa/Mastercard | Yes |

With these options available, traders can choose the method that best suits their needs and preferences. Moreover, deposit bonuses are offered to enhance the trading experience and provide additional value to users. Intermagnum strives to make the deposit process efficient and rewarding for its clients.

Research and Education Resources

Extensive educational resources are readily available through Intermagnum’s Research and Education section, offering a comprehensive learning experience for traders.

- Learning modules: Intermagnum provides structured learning modules covering various aspects of trading, from beginner to advanced levels.

- Expert analysis: Traders can access daily market analysis and expert insights to stay informed about market trends and potential opportunities.

- Video updates: Intermagnum offers video content to enhance educational materials, catering to different learning preferences.

These resources aim to equip traders with the knowledge and skills needed to make informed trading decisions, contributing to a well-rounded trading experience.

Intermagnum Platforms Overview

Intermagnum’s platform suite provides traders with robust tools and features for executing trades efficiently and effectively. The platforms, including Intermagnum WebTrader and Intermagnum, offer a seamless trading experience.

When comparing these platforms, Intermagnum stands out for its user-friendly interface and advanced charting capabilities, while Intermagnum WebTrader excels in its accessibility and performance. User experience improvements have been made across both platforms, enhancing navigation and speed. These enhancements result in a more intuitive and responsive trading environment.

Traders can easily switch between platforms based on their preferences and trading styles. Overall, Intermagnum’s platform suite caters to a wide range of traders, offering diverse options to suit individual needs.

Trading Central Integration

Incorporating advanced tools and features, the Trading Central integration within Intermagnum’s platform suite enhances traders’ decision-making processes with comprehensive analysis and actionable insights.

- Trading Central provides detailed technical analysis on various financial instruments, helping traders identify potential entry and exit points more effectively.

- The integration offers valuable market insights, including key levels, trends, and potential price movements based on technical indicators.

- Traders can access real-time alerts and signals from Trading Central, enabling them to stay informed about market developments and make well-informed trading decisions promptly.

Copy Trading Options

Within Intermagnum’s platform suite, traders can utilize various copy trading options to replicate the strategies of successful traders and enhance their own trading experience. Social trading allows users to interact, share insights, and follow the trading activities of others in real-time. This feature fosters a sense of community and enables traders to learn from each other.

Mirror trading, on the other hand, automates the process by directly copying the trades of selected expert traders. This can be beneficial for those who prefer a hands-off approach or lack the time to actively manage their investments. Both social trading and mirror trading provide valuable opportunities for traders to leverage the expertise of others and potentially improve their trading outcomes.

Market Analysis and Updates

Analyzing market trends and providing timely updates is crucial for informed decision-making in trading.

- Technical Analysis:

- Utilizing charts, patterns, and statistical indicators to forecast future price movements.

- Economic Indicators:

- Monitoring factors like GDP, inflation rates, and employment data to gauge the overall health of an economy.

- Real-Time Updates:

- Delivering instant notifications on significant market shifts, news events, and geopolitical developments that may impact trading decisions.

Frequently Asked Questions

Is Intermagnum fraud?

Evaluating the legitimacy of Intermagnum demands a comprehensive examination. This involves verifying its regulatory standing, perusing impartial reviews, and taking into account user feedback. It is imperative to conduct thorough research, seek guidance from financial regulatory bodies, and carefully assess the reliability of your information sources before drawing any conclusions or making financial commitments.

How to leave Intermagnum?

To conclude your Intermagnum experience, kindly reach out to their customer support directly for assistance in shutting down your account. They will furnish you with precise instructions and may request verification of your identity to facilitate the account closure procedure.

What is Intermagnum phone number?

To access Intermagnum customer support’s phone number, kindly navigate to the official Intermagnum website. The ‘Contact Us’ section typically contains contact details, including phone numbers, email addresses, and live chat options for your convenience.

Is Intermagnum regulated by SERNAC?

SERNAC (Servicio Nacional del Consumidor) is a Chilean government agency focused on protecting consumers’ rights, and it does not regulate financial trading platforms or brokers. Regulatory oversight for financial services, including trading platforms like Intermagnum, typically falls under financial regulatory authorities rather than consumer protection agencies. For details on Intermagnum’s regulation, it’s important to refer to financial regulatory bodies relevant to their operation.

Our Review Methodology

Our Intermagnum review is based on gathering information from different tests, reviews, and feedback from various sources on the internet. This approach ensures a comprehensive view that considers multiple perspectives.

You can learn more about our testing process on our “Why Trust Us” and “How We Test” pages. We understand that false information exists online, especially regarding trading platforms that may be scams. We thoroughly compare information to provide an accurate Intermagnum review.

In conclusion, Intermagnum shines like a lighthouse in the vast sea of trading platforms, guiding traders with its safety, innovation, and user-friendly features. Like a skilled navigator, Intermagnum offers a diverse range of investment options, competitive fees, and seamless mobile trading experiences. With a strong regulatory framework and commitment to empowering traders, Intermagnum stands out as a beacon of trust and reliability in the world of online trading.