Market Surveillance Report – April 2019

Our latest report comes on the heels of the Bitwise presentation to the SEC on real bitcoin trade volume. We came to many of these same conclusions on wash trading with our previous methodology, however for the past 4 months, we have been working on new algorithms designed to catch the actual accounts doing the wash trading.

We feel like this approach will make the most difference in turning the tide of the space with regards to manipulation, as top exchanges are already using our data to shut down wash trading accounts. We did not want to keep releasing monthly reports with the same methodology that pointed out what is now widely known without actually being able to do anything about it.

During these months, we have also released over 200 full exchange reports to over 40 crypto projects enquiring about the legitimacy of the various exchanges contacting them for listing. The listing fee costs from just the wash trading exchanges in these reports totaled over 150 BTC. We are glad these reports were able to save some crypto projects from being scammed out of money that could be used for development instead.

BTI has been 100% funded by the proceeds from these reports in building out and improving our wash trade algorithms on individual pairs. We’ve also used these funds to build out a live updating data site which for the first time provides accurate volume data for the space in real time.

Also, since our last report, we have been working with various exchanges in testing our algorithms and helping them catch wash trading accounts on specific pairs. Some of these exchanges even have high dollar trade surveillance software installed which did not provide the proper wash trade alerts. These algorithms provide all the wash free data for our Clean API which builds out our entire new site.

Our data reports on specific pairs to these exchanges have not resulted in one false positive on an overall pair during production yet. They have been used to shut down many wash trading accounts already. These reports include data on trade execution times and sizes, that the exchange compliance team can match to accounts and shut down as needed. We also believe our added layer of wash trade surveillance is an important insurance policy against rogue employees with ties to market makers.

BTI Verified

With this in mind, we have launched the BTI Verified self-regulatory initiative to both certify real volumes and to provide services for exchanges that wish to use our algorithms and data to keep their platform clean.

This new methodology is much more accurate than our previous methodology as it removes suspicious volume on individual pairs being executed between the spread. 26 different data points are analyzed before marking a trade as a wash trade. This sets our methodology apart from our previous work and others, as we can send exchange compliance teams a list of actual trades they can match to accounts and begin to clean the exchange of these manipulations.

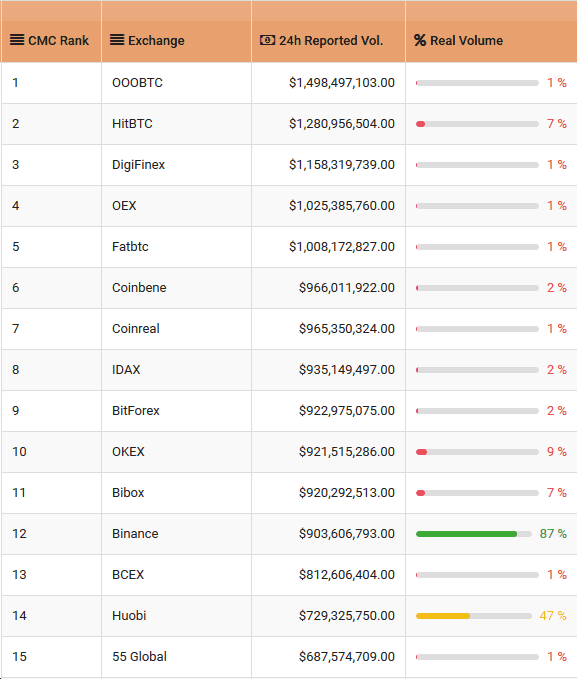

We found 17 of the CMC Top 25 exchanges to be over 99%+ fake, with more than 99.5% fake volumes, including 35 of the top 50 adjusted volume rankings. These exchanges have been completely discounted from appearing on our new site and rankings tables. Over 60% of all exchanges ranked on popular data sites have little to no volume and were found to be over 96% fake each.

Here is a look at the current top 15 on CMC.

Our algorithms connect to exchanges via their public API and websocket connections. Trades are analyzed and these reports are sent to exchanges to investigate the accounts making these trades. If there is an issue with the exchange’s API or they do not respond to us about changing their limits to properly assess the exchange, we use our old methodology of analyzing order book liquidity and volume pattern anomalies, until we are given access to properly analyze the exchange and verify volumes.

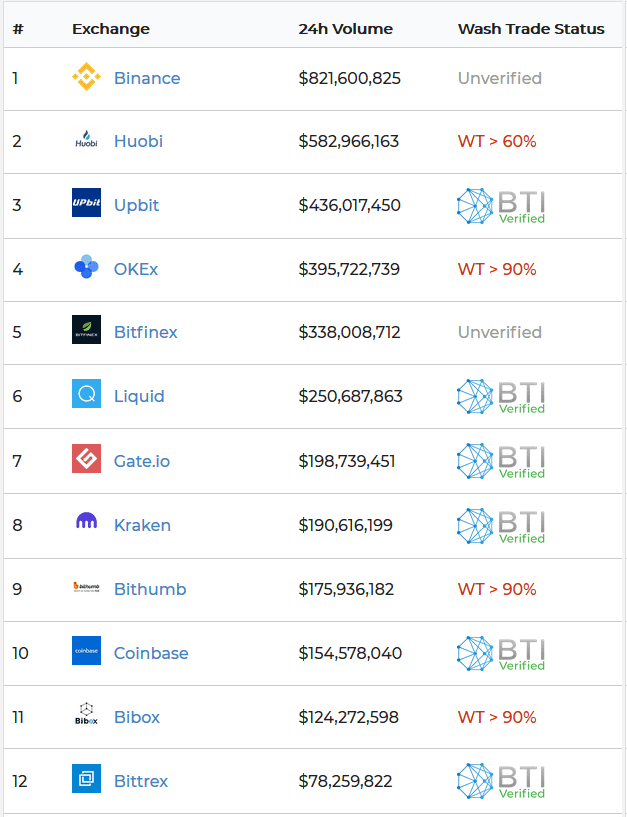

Here is a look at the real top 12 exchanges by volume. Full rankings here.

Exchanges which we have found under 10% wash trading over the past 30 days have been labeled as BTI Verified. Some of these exchanges, as well as others which are not yet Verified, have already been using our data to review and shut down accounts which were found to be wash trading.

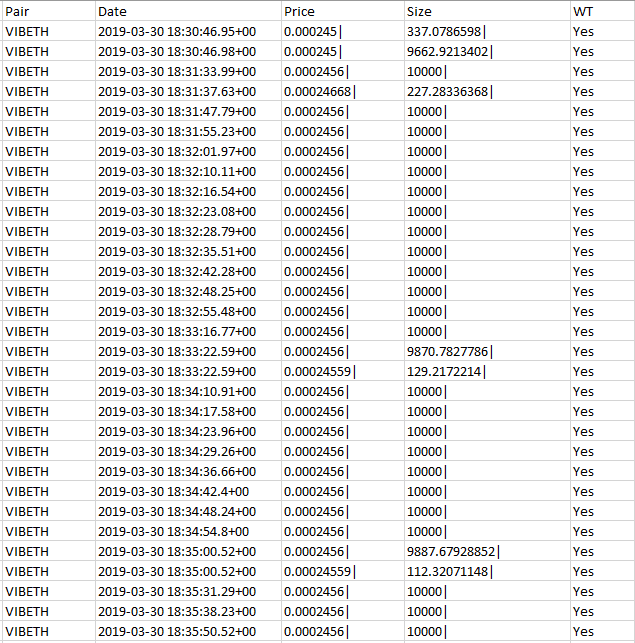

Data reports received by exchanges include trade execution times and sizes which the compliance team can investigate to determine if these trades are all coming from the same account or small group of accounts. We also provide data reports on pump and dump schemes, and irregular volume movement.

Initial BTI Verified exchanges include 9 of the top cleanest exchanges in our rankings. These exchanges include Coinbase, Upbit, Bittrex, Poloniex, Liquid, Kraken, Gate, Bitso, and Lykke. The largest exchanges in the United States, Korea, Japan, and Mexico are all on our initial release and we will be announcing new additions each month. All initial BTI Verified exchanges are over 90% clean with a few that are 97-99% clean including Coinbase and Upbit. Kraken was the cleanest exchange we found with these current algorithms at over 99%.

Binance and Bitfinex are currently unverified on our list as we discovered over 10% wash trading on both exchanges. Data reports have been sent to both and last week Bitfinex was able to confirm that their Irisium wash trading software was focused on their largest volume pairs primarily, and was not tuned into their middle to lower volume pairs. Bitfinex has been hovering around 88-90% clean as a whole with top pairs over 97%+ clean.

Binance’s top volume pairs are also largely clean as we suspected, however market makers and bots are taking advantage of around 30 pairs on the exchange. We have found Binance to be about 85-90% clean depending on the day. These 30 pairs, however, are wash trading between 25% and 75% of their total volume.

Our new exchange rankings table has BTI Verified exchanges listed as well as unverified exchanges which are still under review, without any major red flags from our previous methodology. This new ranking’s list also includes a few large wash trading exchanges because they still have a large amount of real volume even with the manipulated trades removed. However, we have clearly labeled these exchanges according to the amount of wash trading they are continuing to allow.

In the spirit of transparency, it must be noted that we do charge for the service of sending data reports to clean up exchanges, as we must pay our staff to comb through data all day. The cost of this service is based on total exchange volume that must be analyzed daily. However, there is no cost for being BTI Verified. We will verify any exchange that has under 10% wash trading detected with no individual pairs wash trading over 15%, no matter the surveillance method used to achieve this.

A sampling of the data provided to exchanges which is already helping close down wash trading accounts can be seen below:

Suppose greater than 10% wash trading is detected or high volume wash trading on individual pairs is found. In that case, we will send the exchange initial data reports to confirm accuracy and match trades with accounts so they can remove them from trading on the exchange.

We also have a strict policy on which exchanges can be BTI Verified. Any exchange that has been guilty of or allowed over 25% of total volume wash traded on their platform in the past, may only be added as a Verified exchange after 12 months of clean trading.

Wash Trade Tactics

Exchanges which are faking their volumes use a variety of different tactics to try and swindle investors. These tactics we have found, which are included in our individual exchange reports, include buying twitter followers and likes, filling up fake order books, mirror wash trading the largest exchanges with real volume, and trying to disguise their wash trading using various bot settings to not affect price. On many of these exchanges trading high volumes, we would close the spread and watch the volume plummet as the bots had no room to wash trade with themselves.

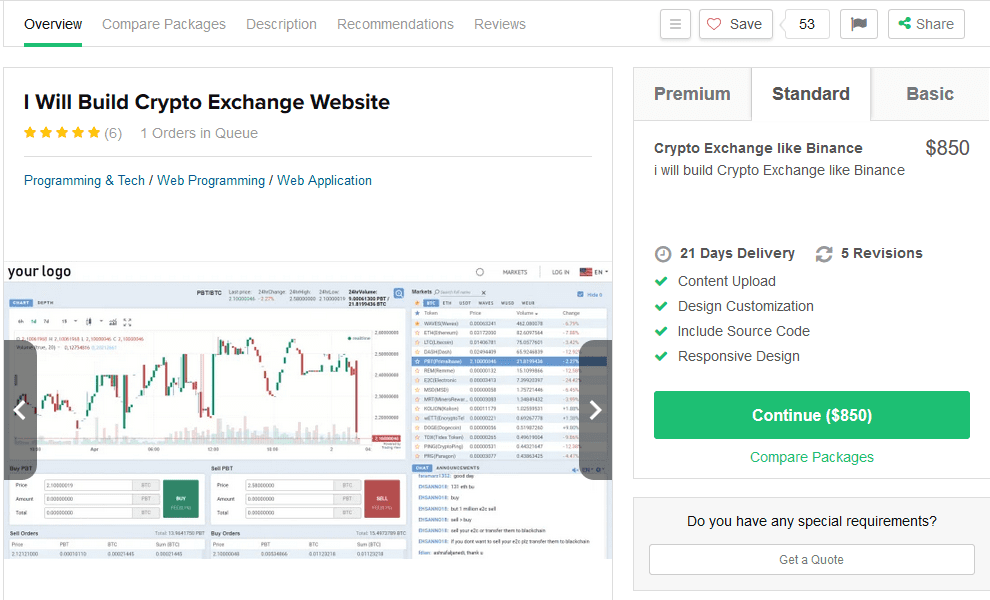

We also dug into many of these exchanges with 99%+ fake volumes and found many share the same trading engine and design. Further exploration into the searches of Fiverr, an online freelancer site, revealed the ability to have a crypto exchange website created for you starting at just $850 to create “an exchange like Binance”, and for just $100 more they will make you your own trading bot to wash trade your way up to the CMC top 10.

It is no wonder the many exchanges we found which are 99%+ fake, now outnumber the clean exchanges on CMC, according to our data.

Bti.live

Our new live updating data site is the home for all clean data in the space. We will also begin sharing this data via our Clean API. Here you can find accurate volumes and data for all coins and exchanges, including social sentiment data and Github activity tracking.

All exchanges combined are currently reporting around $50 Billion in daily volume on CMC. After removing all the wash traded volume via our algorithms the accurate number is around $4-5 Billion. About 88-92% of daily trading volume is fabricated depending on the day. Bitcoin’s daily trading volume is about 92% fabricated, which is in line with the space as a whole when comparing our findings to top data sites reporting wash traded volumes.

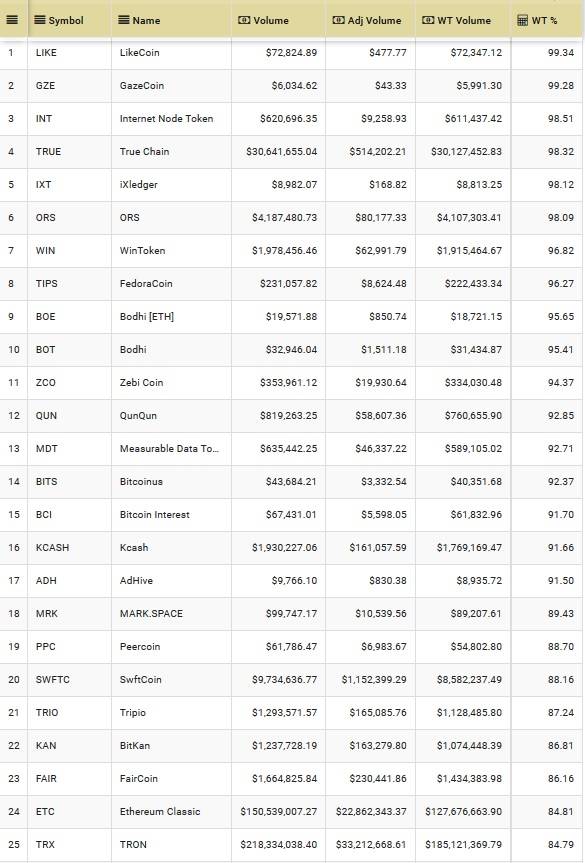

On our list of the top 40 largest exchanges with actual volume, Bitcoin’s volume is about 65% fabricated. Almost all of this fabricated volume comes from OKEx, Bibox, HitBTC, and Huobi. Of the top 25 tokens by marketcap, Tron and Ethereum Classic are the highest wash traded tokens on our list at 85% fake volume each and coming in at #24 and #25 of the most wash traded tokens.

There are currently 150 tokens out of the 567 tokens currently listed on the real top 40 largest exchanges who’s volumes are being wash traded over 50% daily.

The full list of over 500 tokens we analyzed can be found here.

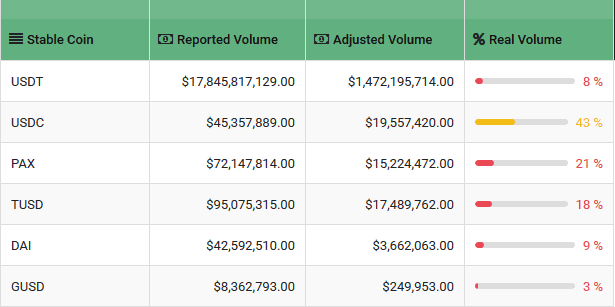

Stable Coins

Most of the new stable coins are primarily listed on the largest wash trading sites in the space. This includes GUSD, DAI, TUSD, and PAX. Of these GUSD has the lowest amount of real volume at just 3%, as they are primarily listed on exchanges wash trading 99%+ of their volumes.

As seen below with all of the wash trading removed, USDT still owns 96% of the total stable coin volume in the space. Currently, USDC has the highest amount of real volume reported of all stable coins at 43%. Almost all of this token’s wash traded volume can be found on LA Token and FatBTC.

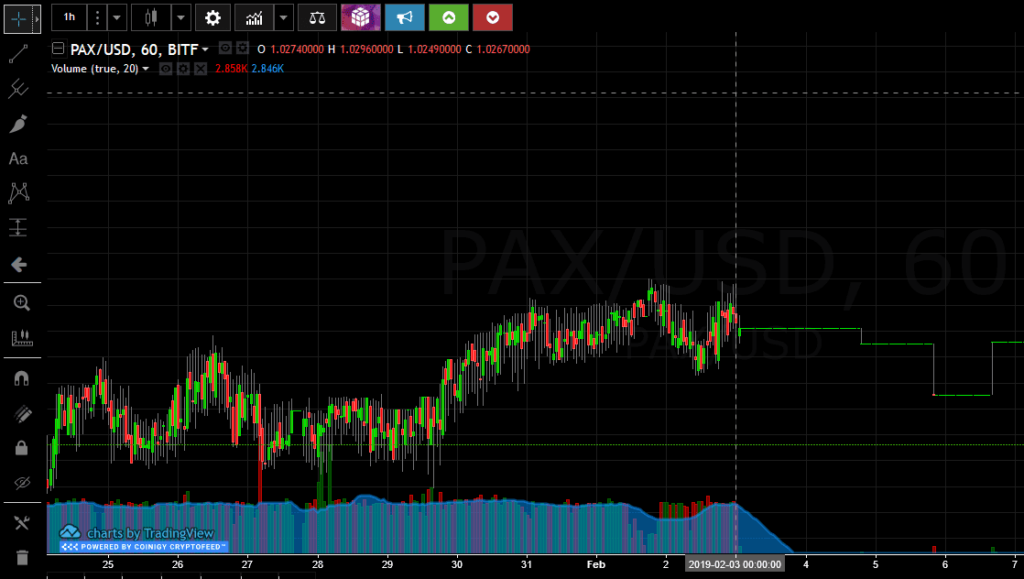

The PAX token caught our attention over the past few months as we have been reviewing exchanges for many other projects. This token is listed on 32 exchanges. 25 of them are wash trading their PAX volumes by over 90%. While 6 of the other 7 have wash trading numbers between 15% and 75%. Upbit was the only exchange which seems to have prevented its wash trading, and as such has one of the lowest PAX volumes. It stood out to us that even the cleanest exchanges had PAX pairs being wash traded.

Below we can see the bot on Bitfinex being turned off at midnight EST on February 3rd. Without the bot’s trading over 95% of the PAX/USD volume disappeared.

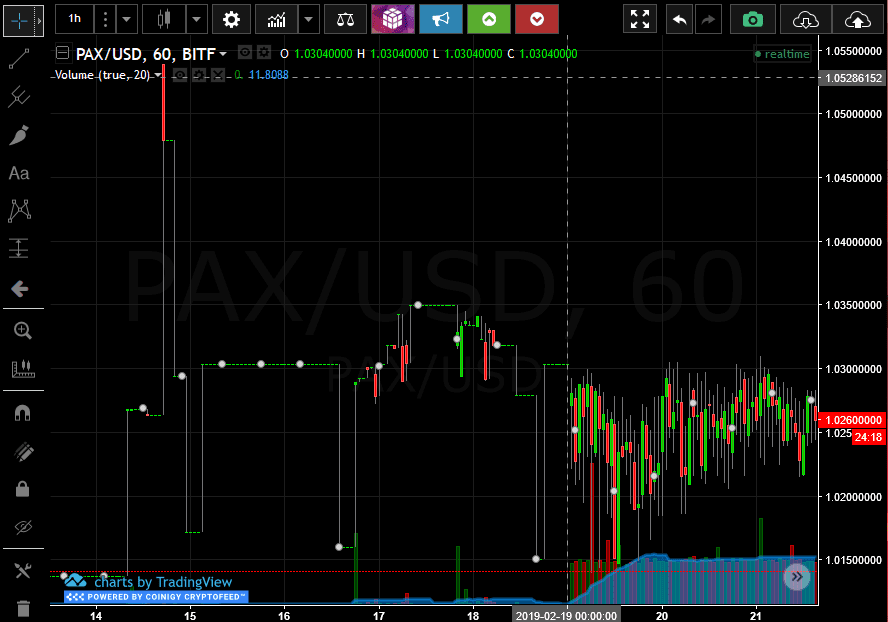

The bot was then reactivated at midnight EST on February 19th, and trading volumes of PAX/USD shot up 10x in minutes. Also, note the repetitious equal buying patterns every hour typical in fake volume pairs.

We will have an updated report on this token next month, however Bitfinex did acknowledge to us that the data we provided via our algorithm (trade execution times and sizes) correctly identified this pair being wash traded and that they are working to close accounts wash trading this pair, as well as others.

Future Projects

We are currently working with top exchange security heads on our Initial Security Report which we hope to have released in the next month. This report will contain best security practices for exchanges to follow to keep customer funds safe from phishing attacks and security breaches.

The team will also get back to work on an Initial Regulatory Report which we also hope to have completed in the next month. We will be interviewing many top officials in the space and in various countries on the direction the space is headed, and how self-regulatory practices can be best implemented to continue to allow adoption to flourish in the coming months and years.

Expect more positive marketing reports in the future from us to guide the space in the right direction, including sponsorship of studies and partnerships in various industries on how blockchain can be used to make current systems more efficient and productive for all.

Over the next months, we will add new Verified exchanges to our rankings as we analyze more of them with our latest algorithms.

BTI began among associates who wanted to make a difference by cleaning up the space. Most media coverages gave blockchain a poor reputation with reports of manipulation, scams, or hacks coming out every other week.

Our team originally started with 4 core members with skills ranging from data science to high frequency trading, and web analytics. We have grown to over 12 contributors who helped shape our reports with their experience and inside knowledge of the industry. Our advisors include ethical market makers, high frequency traders, trade surveillance consultants, and retired C-level executives.

In development of the project including the new data site, BTI has been 100% funded by our original 4 founders as well as the proceeds from full exchange reports from token projects. We have not taken any funding from investors and have spent countless nights and weekends since August 2018 building out this project to what it is today.

All funds received from providing wash trade detection services, exchange reports for token projects, and from our Clean API will be cycled into future projects to promote the space in the best possible light and further adoption.

If you have a passion for promoting blockchain and want to join our staff as either a writer or researcher, please reach out to us as we have big plans for promoting the space in 2022.